Primary Factors That Move Gold:

Gold is a unique and widely recognized precious metal that has historically been considered a safe-haven asset and a store of value. The price of gold can be influenced by various factors, and the top reasons it moves higher include:

1.Geopolitical Uncertainty: Gold tends to perform well during times of geopolitical instability, as investors seek safe-haven assets to protect their wealth from potential risks and uncertainties arising from conflicts or geopolitical tensions.

2.Economic Uncertainty: During economic downturns or periods of economic uncertainty, investors often turn to gold as a safe-haven investment. Gold is considered a hedge against inflation and currency devaluation, as it retains its value when fiat currencies may lose purchasing power.

3.Central Bank Policies: Actions taken by central banks, such as interest rate decisions, quantitative easing, or currency interventions, can impact gold prices. Lower interest rates or expansionary monetary policies can boost gold demand as investors look for alternatives to traditional low-yield investments.

4.Currency Fluctuations: Gold is priced in U.S. dollars, so fluctuations in major currencies can influence its price. A weaker U.S. dollar generally makes gold more attractive to international investors, leading to higher demand and prices.

5.Investor Sentiment: Market sentiment and investor perceptions of risk and uncertainty can drive demand for gold. When investors are concerned about market volatility or potential financial crises, they may allocate more of their portfolios to gold.

6.Global Crisis: Gold often performs well during times of global crises, such as the 2008 financial crisis or the COVID-19 pandemic. During these periods, investors seek the safety and stability that gold can provide.

7.Supply and Demand Dynamics: Changes in gold supply or demand can impact its price. Gold production levels, mining costs, and jewelry demand are factors that affect the overall supply and demand balance.

8.Interest Rates: While low-interest rates can support gold prices, a sudden increase in interest rates might lead to a temporary decline in gold prices, as investors may prefer higher-yielding assets.

9.Inflation Expectations: If investors anticipate rising inflation, they may turn to gold as a hedge against eroding purchasing power.

•It’s important to note that the gold market is influenced by a combination of factors, and its price can be highly volatile. As with any investment, the value of gold can go up or down based on market conditions, and investors should conduct thorough research and consider their risk tolerance before investing in gold or any other asset.

My Reasons For Liking Gold/Silver Long Term

I put this out in August when the Ukraine/Russia war was the only focus. Now we have Israeli-Palestinian conflict that has taken front and center stage. I am seeing different countries starting alliances, including Russia, China, Iran and this is scaring the bajesus out of me. But is also the reason I really like Gold and black gold (Oil) Things are getting very heated right now and hearing WWIII is being heard each and every day. I hope I am wrong about this, but it does look and feel like we are heading exactly in that direction. Gold is a safe haven for geopolitical uncertainty!

From the August report: I am bullish long term on gold/silver because of Geopolitical Uncertainty, being my number 1 reason. My forecast is for Gold/Silver to make an important top between 2026 (earliest) and 2032 (Latest) From my technical view, I am looking for GLD (Gold ETF) to make an important top between 240 and 310, which is a very nice % move from current levels (183) A rising tide takes all boats. The same applies to sectors/indices/precious metals. If GLD heads to the minimum target of 240, that is a 32% increase within the next 3 years. The stocks I like have high odds to move much higher than GLD, so expecting a 50%-100% gains from the current levels, would not surprise me. That is NOT a guarantee, just a projection.

1.Geopolitical Uncertainty: Gold tends to perform well during times of geopolitical instability, as investors seek safe-haven assets to protect their wealth from potential risks and uncertainties arising from conflicts or geopolitical tensions. The chances of us living through WWIII are increasing each and every day. The unfortunate truth is the Russia/Ukraine war can be over in 24 hours, like “some” have said. If Ukraine simply says, we will not join NATO, this war ends instantly. I am NO expert on this subject and this is just my option. China invading Taiwan is yet another concern that COULD trigger WWIII, as well as North Korea, Iran getting their hands on Nukes and many other factors. Gold is a trading instrument and will move higher and lower. But contrary to what many gold bugs say, inflation is not the primary reason that moves gold higher, it is geopolitical uncertainty, especially when it is war, moves gold .

2.Economic Uncertainty: During economic downturns or periods of economic uncertainty, investors often turn to gold as a safe-haven investment. Gold is considered a hedge against inflation and currency devaluation, as it retains its value when fiat currencies may lose purchasing power. Many analysts are on both sides of the fence on this one. But me personally, I do believe we will head into a recession and those odds increase if the left maintains in control. They want fossil fuel gone and that will jump start inflation even more and crush our economy.

3.Currency Fluctuations: Gold is priced in U.S. dollars, so fluctuations in major currencies can influence its price. A weaker U.S. dollar generally makes gold more attractive to international investors, leading to higher demand and prices. The only thing I know about this, is that the CBDC (Central Bank Digital Currency) is much closer than you think. It will be a disaster and it will cause “Currency Fluctuations” around the world.

4.Inflation Expectations: If investors anticipate rising inflation, they may turn to gold as a hedge against eroding purchasing power. Inflation has come down, but core inflation is sticky. If Oil moves higher (It is) then inflation will start to move higher again. If left wins in 2024, inflation will be at level s never seen before.

August Report: Looking at GLD on the weekly charts, I do see a sell signal, which brought GLD down from 190-ish to 176.15. That MAY be the low, but I am leaving the door open for a move down to 167.69. I will be using any weakness to buy all the way down to 150.63. If GLD breaks above the 194.45, it will be breaking out and the support levels will not come into play.

10/26/23 Report: I left the door open for a move down to the 167.69 where I suggested buying weakness all the way down to 150.63. (GLD was at 181 at the time) GLD made it down to the 168 and then shot back up to 185 in just 2 weeks. Notice the HUGE inverted head/shoulders pattern (green circles) That has an upside target of 240-ish, which has always been my upside target 1. We may need more time to form the right shoulder, being I am expecting some backing and filling from the 185 top.

August Report: The daily charts are showing buy signals as GLD touched the 200 dma. Being the weekly chart is showing some sell signals, opens the door for a test of the 168.16 or closing the gap at 160.18. Don’t fight the breakout if that comes first (Above the 194.45)

10/26/23: The daily chart from August actually did nail THE EXACT LOW on GLD. I am NOT seeing sell signals, but they may not come until we see the 193 resistance. The preferred pattern right now, is for GLD to do some backing and filling down to the 174.50/175 support and then rally up to the 193/194 resistance (Neck line of the weekly inverted/head shoulders pattern). But if you look at the daily chart below, you will see there is a small (still big) inverted head/shoulders pattern forming. Look to buy down to the 175/174 support for the next rally up to the 194/193.

I didn’t change the time sequence chart, being it is just showing the long term top I am watching. Looking at GLD with Time/Price Sequence, we can see how I produced my upside target. The time piece is showing a top coming in some time between 2026/2027. If that time period does NOT hold down GLD, then we will be looking at a move into 2032 with a 310 top. Time sequence-Low 11/23/2015 -top 08/03/2020. Forecast sequence: Low 10/17/2022-Top 10/17/2027

From August Report: (AU) Anglo Gold Ashanti Headquartered in Johannesburg, South Africa, is a gold mining company operating mines across Africa, Australia, and the Americas. Despite a more conservative earnings forecast compared to other mentioned companies, AngloGold has an impressive track record of consistently increasing its earnings per share (EPS) since 2015. Though there was a slight sales dip in 2021 versus 2020, overall sales have been on an upward trend since 2018. Over the past decade, AU’s share price has generally remained within a specific range, but it stands out among gold stocks by currently trading above its 200-day moving average. In 2023, the stock experienced a pullback after a significant rally in late 2022. AngloGold Ashanti offers a dividend yield of 2.4%, with the dividend amount subject to significant variation from year to year. Currently, the company’s price-to-earnings (P/E) ratio is 28.7, which is considered moderate for this stock.

10/26/23: AU remains one of my favorite gold stocks to invest in for the long term. I was looking for a pullback down to the 17.61/1626 (from 22.27 in August) and it did go a bit further, but has now rallied back to the 19’s again. I am NOT sure if it tests the 17 again, but I would leave the door open for that test. But building a position up here and leaving some powder dry in case we do get the pullback, make sense. NOTICE THE PURPLE CHANNEL!! The long term upside target would be around 36 or higher. It depends on when it gets up there, as the channel line is rising. That is at least a double from these levels. I like buying dips on AU and just tucking it away!

(GFI) Gold Fields Limited is a South African-based company, operates gold mining ventures in multiple countries, including South Africa, Ghana, Australia, and Peru. In recent times, Gold Fields has proven to be a consistent performer,

witnessing sales growth since 2016 and an increase in earnings per share (EPS) since 2019. Analysts project a moderate yearly growth trajectory for the company in the future. During 2019 and 2020, GFI experienced a notable rally, but it has since stabilized, trading within a range of $7 to $17. Currently, the stock price is situated near the lower end of this range. Among the listed companies, Gold Fields offers the highest dividend yield at 3.9%. However, like many other gold-related stocks, the dividend payment may fluctuate from year to year. With a price-to-earnings (P/E) ratio of 14.1, GFI’s valuation is relatively low compared to the readings observed over the last five years. The lowest P/E reading was just below 7.0, recorded in late 2022.

August Report: (GFI) Weekly is trading within a very large up trending channel and is a bit overbought. I am going to wait and see if I can start building my long position closer to the 12.60 support. I see this stock trading in the 30’s or higher come 2026/2027. I am going to be patient, but not try and be perfect. As you can see, it has some big moves in both direction and the last one looks like it is a top—for now. If it does follow this channel, then the low 10’s would be the next stop. Don’t chase this here, but it is a stock for a long-term investment and will look to build on weakness.

10/26/23: (GFI) Weekly My suggestion for building a position in GFI, was NOT to chase and wait for a pullback down to the 12 and the 10 support. As you can see below, GFI made it down to 10.31 and jumped almost 40% higher off those lows. I like buying weakness down to the 12.60 and then waiting to see if they test the 10.30 again. I would NOT try and be perfect and building a position from here, it has high odds of trading in the 30’s before Gold tops.

August Report: (GFI) Daily is a little tricky to forecast short term movement. There were bullish divergences at the 13 low, and we saw a nice bounce into resistance at 16. There is a CHANCE we are making an inverted head/shoulder (bullish) which would take GFI towards the 17.50 highs or higher. But if looking at this as a long-term investment, one can dabble very small, but I am waiting for a pullback down to the 14.50 13.00/12.60 support zone.

10/26/23: Momentum is quite overbought here and seeing if you can buy down near the 12.50/11.90 support is the safest for new entries. August gold members, just manage trade and ad on weakness. The preferred pattern would be for a pullback before seeing a run up to the 16 resistance. Remember, this stock moves very fast!!

(DRD) DRDGold, another South African company, focuses on gold extraction and processing from two properties in South Africa.

Over the years, the company has consistently increased its sales since 2015, with only a few minor setbacks. Moreover, its earnings per share (EPS) has been positive for the last four years, showing an overall upward trend, albeit lower in 2022 compared to 2021.

DRDGold experienced a remarkable rally of nearly 900% between mid-2019 and mid-2020. However, it has since been retracing from that peak. Presently, the company offers a dividend yield of approximately 3.0%, though the dividend amount varies from year to year.

The current price-to-earnings (P/E) ratio stands at 11.2, representing one of the lowest readings observed over the last five years.

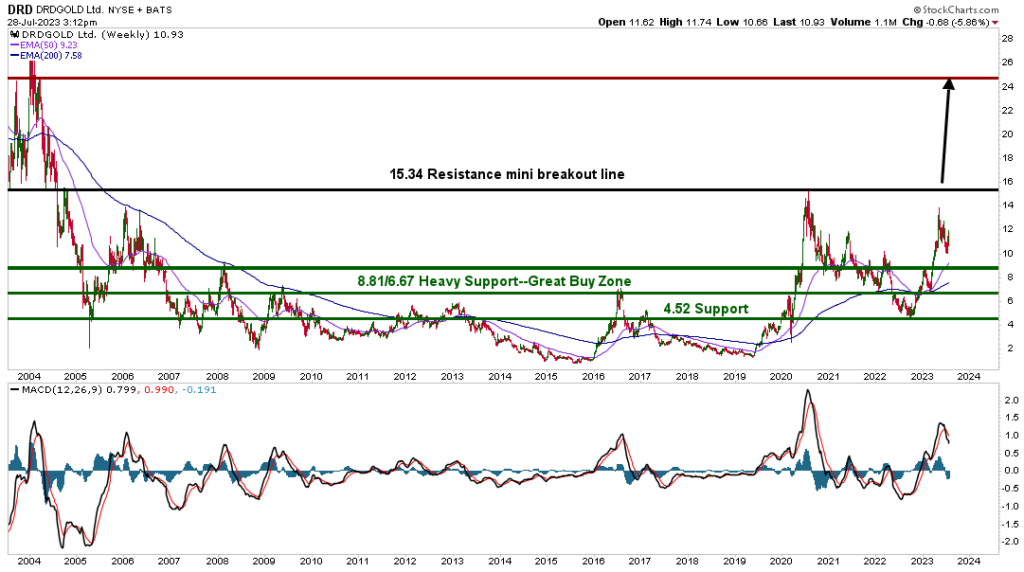

August Report: (DRD) Weekly DRD is another stock I would either wait for a breakout (above 15.34) for a move up to 24.50. But that is more of a trade set up. I like buying weakness/dips between 8.81/6.67 and leaving some powder for a chance to buy near 4.52. It is quite overbought and SMALL sell signals. It is a highflyer and moves quickly. But risk/reward for long term investment, looks good.

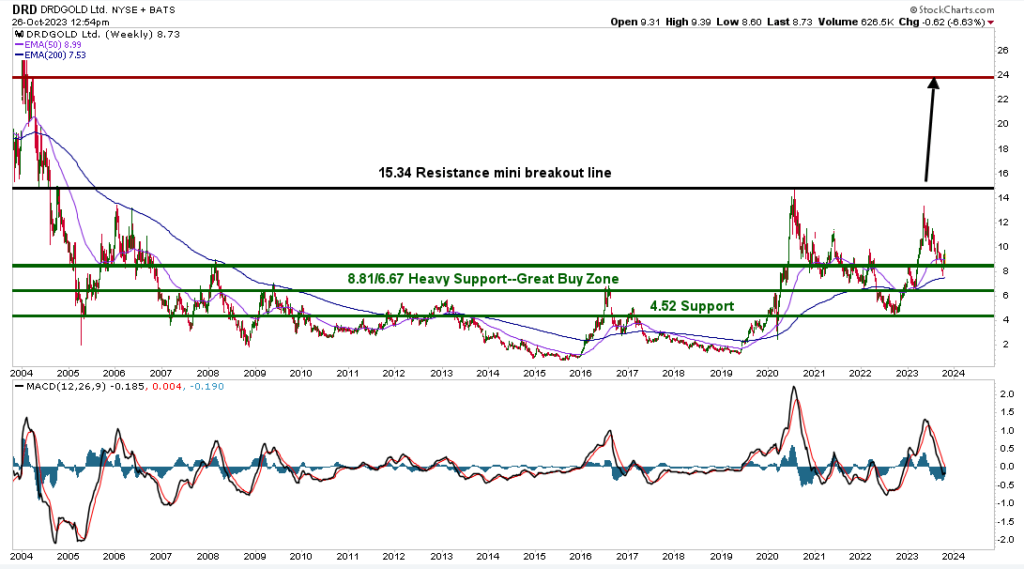

10/26/23: (DRD) Weekly DRD pulled back right into the buy zone from August and jumped some 30% off those lows. There is an open gap that MAY get filled at 8.11, but building here down to the 8.11 should be good for the next move higher. Don’t try and be perfect, the long term upside target is in the 20’s.

August Report: (DRD) Daily is another kind of hard to forecast short term. If it gets above 15.34, it will be breaking out and heading to the 24’s. I would like to buy dips between 9.98/8.88 and then leave some powder dry for a possible test of 6.75/4.67. I do see the 24’s or higher coming into play by 2026/2027

10/26/23: DRD di d give us a great buying opportunity when it pulled back to our buy zone. I am not against building a position from today’s price and seeing if you can get filled near the 8/7.60 range. But the pattern does look like a bull flag, suggesting we will see DRD higher before lower. For the long term, we could see DRD in the 20’s in the coming years.

From a fundamental/geopolitical view, GOLD is in a perfect storm. Inflation remain sticky, rates will stay higher into 2024, 2 wars going on and a possible gov’t shut down. We could see GLD and gold stocks make the second run higher sooner than expected. G

Information is for paid subscribers & may not be copied or distributed. © Copyright 2023. The information contained herein was provided by Sentiment Timing and/or its publishers does not make any representation or warrant with regard hereto, including but not limited to those of accuracy, completeness, reliability, timeliness and/or infringement on the rights of third parties. This Publication expresses a view on the markets but is not intended to provide any specific recommendation to buy or sell any security. Investing is Uncertain and always carries Risk. Of Losses. Subscribers should always assess Market Risk parameters with their broker or financial adviser.

Information is for paid customers and may not be copied or distributed Copyright 2023