Please Bookmark this page for future use!!

Why I Believe Gold and Silver Are Positioned to Move Higher From Here

When I first laid out my bullish stance on gold and silver back in 2023, See Here my top reason wasn’t inflation, the Fed, or rate cuts — it was geopolitical escalation and the breakdown in international stability. That hasn’t gone away — it has intensified. What was once a regional conflict theme (Ukraine/Russia) has now evolved into a global alignment shift — we’re watching nations reposition, alliances form in real time, capital move defensively, and governments openly discuss financial control measures that were unthinkable just two years ago.

Back then, I said gold responds to uncertainty — especially war risk. Today, we’re not just talking about war risk — we’re talking about capital restriction risk, currency fragmentation, state-level asset seizures, and even digital currency enforcement backed by policy threat. This is no longer a market simply “hedging inflation.” This is capital actively looking for a way to exit the financial system’s line of fire — and gold is the cleanest way to do that.

I continue to believe that geopolitical instability remains the number one driver of the next leg higher in gold and silver, not CPI prints or Fed dot plots. The narrative has shifted from “will gold hold value?” to “where can capital go where it isn’t someone else’s liability?” That single question — asked quietly by sovereign funds, high-net capital, and eventually the public — is what pushes gold from being a slow mover to a repricing event. And when that line is crossed, silver follows with velocity, and miners catch fire after confirmation — not before.

GLD pushing into the 370s changes the conversation entirely. When I first laid out the 240–310 projection, that zone represented the initial breakout and recognition phase. That phase played out — and now we are in what I would call the transition from acceptance to acceleration, which aligns with the early stage of public capital awakening.

Now that GLD has already cleared 310 and is trading near 376.75, the new upside expansion zone shifts higher:

| Phase | GLD Zone (Updated) | Meaning in the Capital Cycle |

|---|---|---|

| Accumulation / Quiet Phase | ✅ Completed (below 240) | Smart money phase — done |

| Recognition Phase | ✅ 240–310 (passed) | Market wakes up, but controlled — done |

| Acceptance / Expansion Phase | 310–420 (current zone) | Early crowd acceptance — this is where we are now |

| Acceleration / Panic Allocation Phase | 420–500+ | Public + money managers rotate in force — gold stops trading, starts repricing |

My Updated Long-Term Projection

With GLD at 376.75, I now see 420–500+ as the next major revaluation band, with silver and miners still lagging — which is historically exactly what you want before the vertical phase.

I stand by the view that the real parabolic phase in precious metals won’t start until we cross 420 on GLD and hold it like a floor, not resistance. Above that, it stops being an “investment” and starts acting like capital insurance — and that’s when allocations happen in chunks, not small inflows.

📊 GLD Elliott Wave Outlook — 1–3 Month Tactical Count

Current GLD Price: ~376.75

Based on institutional Elliott Wave models (converted from /GC to GLD equivalents):

| Wave Stage | GLD Level | Interpretation |

|---|---|---|

| ✅ Wave 2 Correction Completed | Held above 350–360 support | That sideways/profit-taking phase likely closed out minor Wave 2 |

| 🚀 Entering Wave 3 (impulsive leg) | Now trading in 370s | This is the ignition phase — early breakout pressure is building |

| 🎯 1–3 Month Target Zone (Minor Wave 3) | GLD 395–410 | Typical 1.0–1.382 fib projection zone for Wave 3 of a smaller degree |

| 🔴 Invalidation Level | Below GLD 360 | A break under 360 would weaken this immediate Wave 3 count |

Translation: As long as 360 holds, I treat all dips as Wave 3 pullbacks, not trend breaks. First aggressive resistance test is 395–410.

📈 Long-Term Elliott Wave Structure (GLD Supercycle View)

GLD now sits well above your original projection zone of 240–310, meaning we have completed the recognition phase and entered acceptance territory in the bigger Elliott cycle.

| Wave Degree | GLD Phase Zones | Cycle Psychology |

|---|---|---|

| ✅ Cycle Wave II Correction | 2011–2018 | Multi-year consolidation and sentiment exhaustion |

| ✅ Cycle Wave III Triggered | GLD 240–310 (Completed) | Smart money accumulation and early breakout |

| Now Active — Primary Wave 3 inside Cycle III | GLD 310–420 (Current) | Acceptance phase — capital begins repositioning, but without panic yet |

| Future Acceleration Phase (Wave III of III) | GLD 420–500+ | Public participation and forced allocation begins — potential parabolic slope |

| Projected Supercycle Peak Zone | GLD 500–650 (equivalent to gold $5,500–6,000) | Melt-up phase — typically ends in exhaustion/derivative blowout event |

🧭 GLD – Short-Term (1–10 Day) Minute Wave Structure Expectation

Assumption: GLD is in Minor Wave 3 → drilling down into Minute Waves inside that impulsive leg.

| Expected Minute Wave | GLD Price Behavior | What to Watch For |

|---|---|---|

| Minute Wave (i) – Up Thrust | Push toward 380–384 | Should be impulsive, fast. Volume should expand briefly. |

| Minute Wave (ii) – Pullback / Trap Reset | Dip back toward 372–374 | Must hold ABOVE 370–372, otherwise momentum fades & wave count weakens. |

| Minute Wave (iii) – Strong Impulse | Target 387–392 | This should be the strongest leg — shallow dips, aggressive candles, minimal hesitation. |

| Minute Wave (iv) – Flag / Chop / Short Trap | Sideways or shallow drop into 382–384 | Should NOT break 380 — if price drifts too deep, wave symmetry breaks. |

| Minute Wave (v) – Terminal Push | Final thrust toward 395–400 zone | End of this micro structure → sets up larger pullback before next major extension. |

GLD has some gamma resistance at 380, where I would think we will do some backing and filling down to the 375-370 support, which should hold. I would wait for the retrace to build a long position layering in at 375-ish and then 370-ish.

SLV is right at the gamma resistance call wall. If it can get above and we see dealers move that call wall up, that would be the next upside target. I like building a position at 46.36 buy 1, 46 buy 2 and then 45.50 buy 3.

Gold Stock Leaders

AU is one of the leaders in gold and should outperform if gold continues higher. AU either completed a wave 4 down and is starting a wave 5 up towards the 80-85 targets. But AU MAY also be making an ABC wave 4 down and then makes its way up to the 80-85 targets. Below 72.50 would be the first clue that the wave 4 is still being worked out and buying near the between the 67.50-65.00 should work.

NEM is another Gold leader and looks like it is consolidating before breaking higher towards the 100 upside target. A pullback down to 86.50 looks like a good entry–IF it gives us the chance.

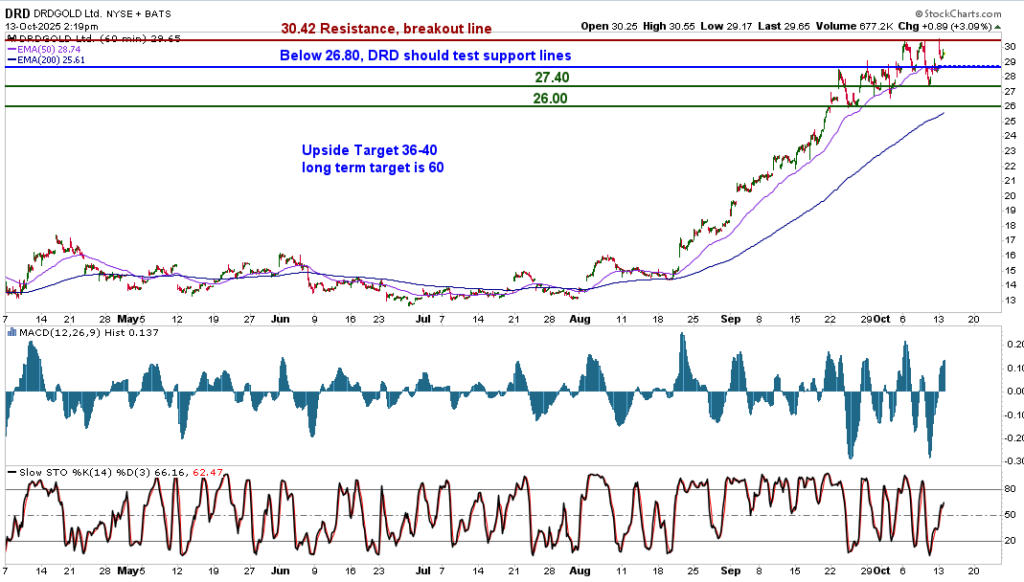

DRD is a stock I have been following since the 2023 report when it was trading at $6 a share. see here I had a $26 price target which was actually met last month and it has been moving sideways between 30 and 26.50. If it breaks above 30 and that is accepted by traders, then I see a move up towards the 36-40 targets and eventually make its way up to 60 in the coming years.

Gold Stocks Under $15 That Should Double With Gold

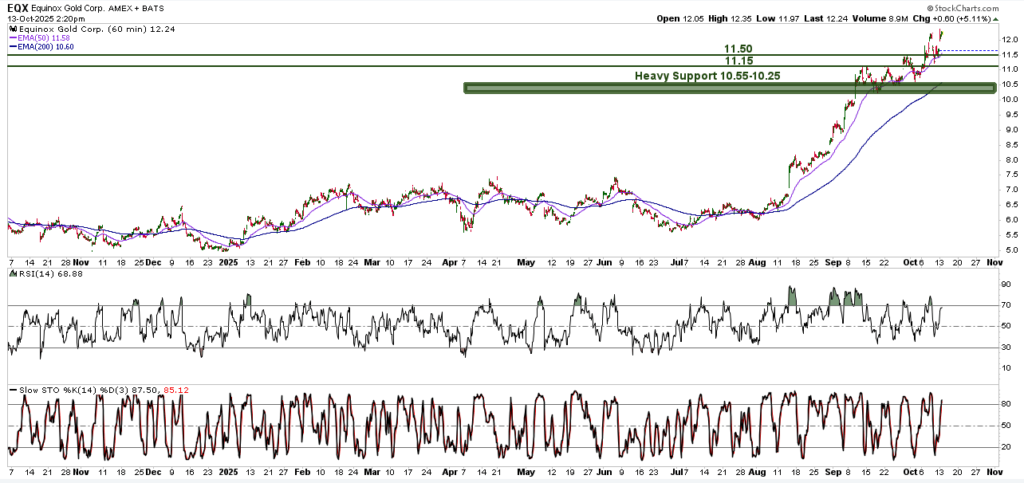

EQX has had a big move and looks like it is consolidating. It would be a better buy at 11.50, but it may not give ius a chance. Maybe building a position where it is now and if it does pullback, buy at support pivots.

BTG has had a big run and has been consolidating 5.40-5.00. Building a position here and if it pulls back, buy at support pivots should work. Upside target 3-6 months is 7.50 and then 10.

Like most of the gold stocks NG has had a big mave and is consolidating between 10.45 and 9.60. If it breaks out above 10.45, it should make a run towards 12.50-15 with 20 being a long term upside target. Buying at support is better, but again, it may not allow us.